Trends and Outlook

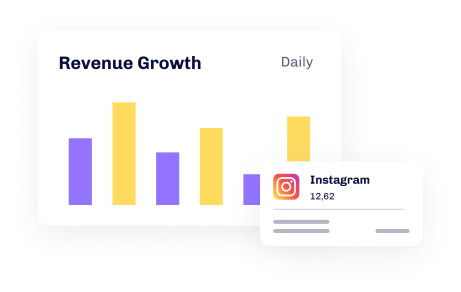

50%

Approximately 50% of financial institutions using AI have seen significant improvements in customer experience.

32%

Approximately 32% of financial firms use AI for risk management and fraud detection, enhancing security and minimizing losses.

50%

Half of the Largest Financial institutions in Europe and the U.S. have adopted centralized AI strategies, effectively scaling their initiatives.

30%

Adopting AI and machine learning technologies can reduce operational costs by up to 30%, optimizing resources and driving growth.

The financial services industry is undergoing a massive transformation with the advent of AI and digital innovations. The democratization of public markets, the rise of digital currencies, and the emergence of fintech are reshaping the market, creating challenges and opportunities for all participants. To thrive in this rapidly changing environment, Imperium Dynamics leverages Microsoft Business Applications and AI to provide the expertise and solutions needed to navigate complexities and achieve success.

Current Industry Challenges

Rapid Technological Change

Keeping pace with technological advancements, such as AI and machine learning, can be daunting, especially for firms reliant on legacy systems.

Regulatory Compliance

Evolving regulations require financial institutions to be agile and proactive in managing compliance to avoid costly penalties.

Cybersecurity Threats

Protecting sensitive financial data from cyber threats is a top priority as attacks grow more sophisticated.

Evolving Customer Expectations

Customers demand more personalized, seamless digital experiences, placing pressure on firms to innovate continuously.

How Microsoft Business Applications Solve Financial Industry Challenges

Enhanced Customer Experience

AI-powered tools from Microsoft improve customer engagement by offering personalized financial services and insights. These solutions leverage data analytics to anticipate client needs, provide tailored advice, and ensure a seamless customer journey across all touchpoints.

Improved Risk Management & Compliance

Managing risk and ensuring compliance with evolving regulations are critical challenges for the financial services industry. Microsoft's AI-powered tools enable advanced risk modeling, predictive analytics, and real-time monitoring, helping institutions proactively identify risks and ensure compliance. This minimizes penalties and enhances overall risk management.

Increased Operational Efficiency

Financial institutions often struggle with legacy systems that hinder agility and innovation. Microsoft Business Applications offer cloud-based solutions that modernize core banking and payment systems, streamline operations, and reduce infrastructure costs. By leveraging AI, these solutions automate routine tasks, free up resources for strategic initiatives, and improve overall efficiency.

Sustainability and ESG Integration

As ESG priorities grow, financial institutions must integrate sustainability into their operations. Microsoft's AI and analytics empower firms to track, measure, and report on ESG initiatives effectively, meeting regulatory requirements and aligning with demands for responsible finance.

Driving Financial Excellence with Microsoft Business Applications

Document Management with Acadia

Document management is crucial for maintaining compliance and operational efficiency in the financial sector. Acadia, integrated with Microsoft AI tools, offers robust solutions for securely managing documents, streamlining workflows, and ensuring regulatory adherence. This platform enables financial institutions to efficiently process large volumes of documents, minimize manual effort, and enhance data accuracy.

360 Degree View for Personalized Investments

Utilizing AI, financial institutions can build a comprehensive 360-degree view of their clients, aggregating data from diverse sources to craft personalized investment strategies. This data-driven, holistic approach allows for more accurate risk assessments, tailored financial advice, and improved client satisfaction, fostering deeper relationships and loyalty.

Explore our Financial Webinar

Watch our on-demand webinars to see how we are addressing Financial use use cases and challenges heads-on.

13

September, 2024

Acadia

Mastering Document Management with AI-Powered Solutions

A Conversation with Imperium Dynamics on how you can take your document lifecycle from 3 weeks to 3 days with accuracy and efficiency using Acadia.

17

October, 2024

Unleashing Team Collaboration with Power Apps:

A conversation on Real-Time Authoring and AI-Enhance Development

Explore the latest advancements in Power Apps that are reshaping how teams collaborate and innovate. This webinar will showcase the new real-time co-authoring feature in Canvas Apps and the introduction of AI-powered Copilot in Model-Driven Apps. Learn how you can leverage these tools to accelerate app development, streamline workflows, and enhance collaboration across teams with Imperium Dynamics.

Transform Your Financial Services Operation With Microsoft Business Applications.

Book a free consultation call to start your journey. Let's talk with our customer success manager about your specific challenges and explore how we can help you overcome them.

Book a Call